utah state tax commission property tax division

Property Tax Division Series 4119 show the final valuations derived in part from these submissions valuations often penciled into the return. TOPICS CREDITS ADDITIONS ETC.

Pub 10 Utah Telephone Directory For Tax Practitioners

Utah State Tax Commission.

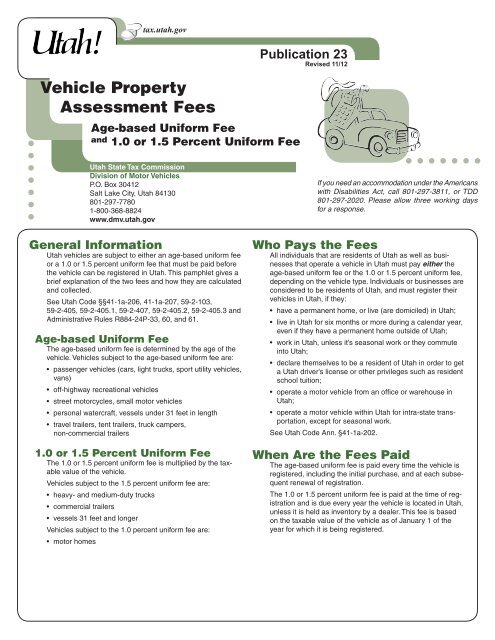

. Personal Property Created Date. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. And Registered Vehicle Uniform Fees.

100 East Center Street Suite 2300. The Recorders Office and the Surveyors Office records the boundaries and ownership of each property in the county. 3302022 20359 PM.

Master File 210 North 1950 West Salt Lake City UT 84134-3310 Fax. Utah State Tax Commission. Utah State Tax Commission Property Tax Division 1122022.

These schedules are to be used to establish taxable value for personal property in the 2021 assessment year. Contact us by phone click on the Phone tab above for numbers. Utah State Tax Commission.

Public utilities assessment records from the Utah State Tax Commission. TAP should be available on Saturday March 12th at 8am MDT. Utah State Tax Commission.

13 rows Property Tax. Please contact us at 801-297-2200 or taxmasterutahgov for more information. The Utah State Tax Commission created in 1931 consists of four members not more than two of whom may belong to the same political party.

Tobacco Cigarette Taxes. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. The Utah County Treasurers Office is responsible for maintaining the mailing address of both the Valuation Notice which is mailed approximately at the end of July and the Property Tax Notice which is mailed approximately the third week of October each year.

This series is protected for 30 years because of competitive disadvantage. The Official Website of the State of Utah. Note regarding online filing and paying.

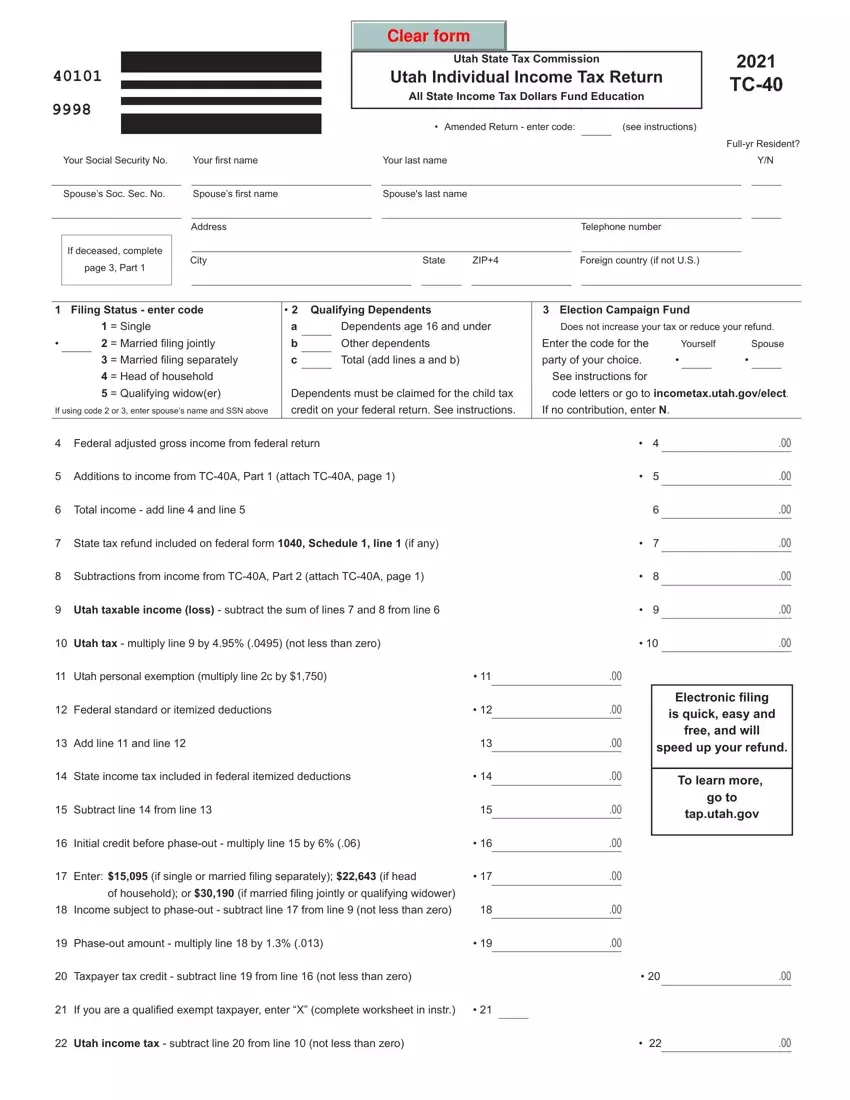

You can also change your address when you file your TC-40 Individual Income Tax return. If you are mailing a check or money order please write in your account number and filing period or use a payment coupon. I Percent Good Table.

Utah State Tax Commission Attn. Business Tax Accounts sales withholding etc. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Please note that our offices will be closed November 25 and November 26 2021 for the Thanksgiving Holiday Pay over the phone by calling 801-980-3620 Option 1 for real property. Property taxes in Utah are managed through the collaborative effort of several elected county offices. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

2022 Personal Property Classification Guide Author. 2021 tax rates by tax area utah state tax commission property tax division tax area 001 - 0000 1010 beaver 0001519 0001519 0001519 1015 multicounty assessing collecting levy 0000012 0000012 0000012 1020 county assessing collecting levy 0000329 0000329 0000329 2010 beaver county school district 0006089 0006089 0006089. Ad Property Taxes Info.

Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. Over 100 awards set Utahgov as one of the best government sites in the nation. The name and address used for mailing will be the name and address on the vesting title document on record as of January.

After 30 years the information. The ClerkAuditors Office calculates the property tax rate based on budget. Utah State Tax Commission Subject.

Business Personal Property801 851. Class 2 - Computer Integrated Machinery 2. 9848 - Agricultural land questionnaires 9773 - Annual agricultural land studies report 22324 - Annual statistical reports.

For security reasons our e-services are not available in most countries outside the United States. What you need to pay online. Payment coupons are available for most tax types on the forms page.

To pay Real Property Taxes. Motor Vehicle Taxes Fees. UTAH STATE TAX COMMISSION PROPERTY TAX DIVISION 2021 Recommended Personal Property Valuation Schedules METHODOLOGY The Recommended Personal Property Valuation Schedules presented herein are contained in Administrative Rule 884-24P-33.

Online Property Taxes Information At Your Fingertips. UTAH STATE TAX COMMISSION PROPERTY TAX DIVISION. UTAH STATE TAX COMMISSION PROPERTY TAX DIVISION PT-31SDG INSTRUCTIONS CAPITALIZED NET REVENUE CNR The CNR method of valuation utilizes historical income and costs based on the taxpayers actual operating history for the past five years or less if operating less than five years.

The Income Tax site might be intermittently down for scheduled maintenance on Friday April 8th between 6pm 8pm MDT. File electronically using Taxpayer Access Point at taputahgov. The Assessors Office estimates the fair market value of each property.

Class 1 - Short Life Property 1. Introduction Methodology. The following information is for county software developers designing.

Utah law requires Commissioners represent composite skills in accounting law auditing property assessment management and finance. The Governor with consent of the Senate appoints members to four-year terms. TAP will be down for maintenance starting Friday March 11th at 5pm MDT.

Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers.

Utah Tax Commission Private Letter Ruling 05 007 Utah State Tax

Utah State Tax Commission Notice Of Change Sample 1

Pub 10 Utah Telephone Directory For Tax Practitioners

Pay Taxes Utah County Treasurer

Pub 10 Utah Telephone Directory For Tax Practitioners

Utah Tc 40 Form Fill Out Printable Pdf Forms Online

Pub 23 Utah Vehicle Property Assessment Fees Utah State Tax

Utah Property Tax Property Tax Resources

State Tax Forms Print Fill Online Printable Fillable Blank Pdffiller

Utah State Tax Commission Notice Of Change Sample 1